Financial Innovation of the Month: Featuring the RBC Remote Account Open experience.

Opening a bank account just got easier.

Accessing financial services is getting easier and safer for Canadians and that’s good news as the economy slowly starts to reopen and people begin to adapt to new routines in the way they live, work and even bank. The financial innovation that caught our attention this month is RBC’s new Remote Account Open experience. What’s unique about it is that the entire process is digital, including the ID validation. From start to finish, it takes a matter of minutes.

For context, and speaking from first-hand experience when I used to work at RBC during my university days, the old way of opening accounts was in-person, and about 30 minutes in length. I would complete the client application form, physically check their ID, print off a pretty lengthy client agreement that the client would sign, then issue a client card and the person would set their PIN. Off they would go until a new banking need popped up and they needed to return to the branch.

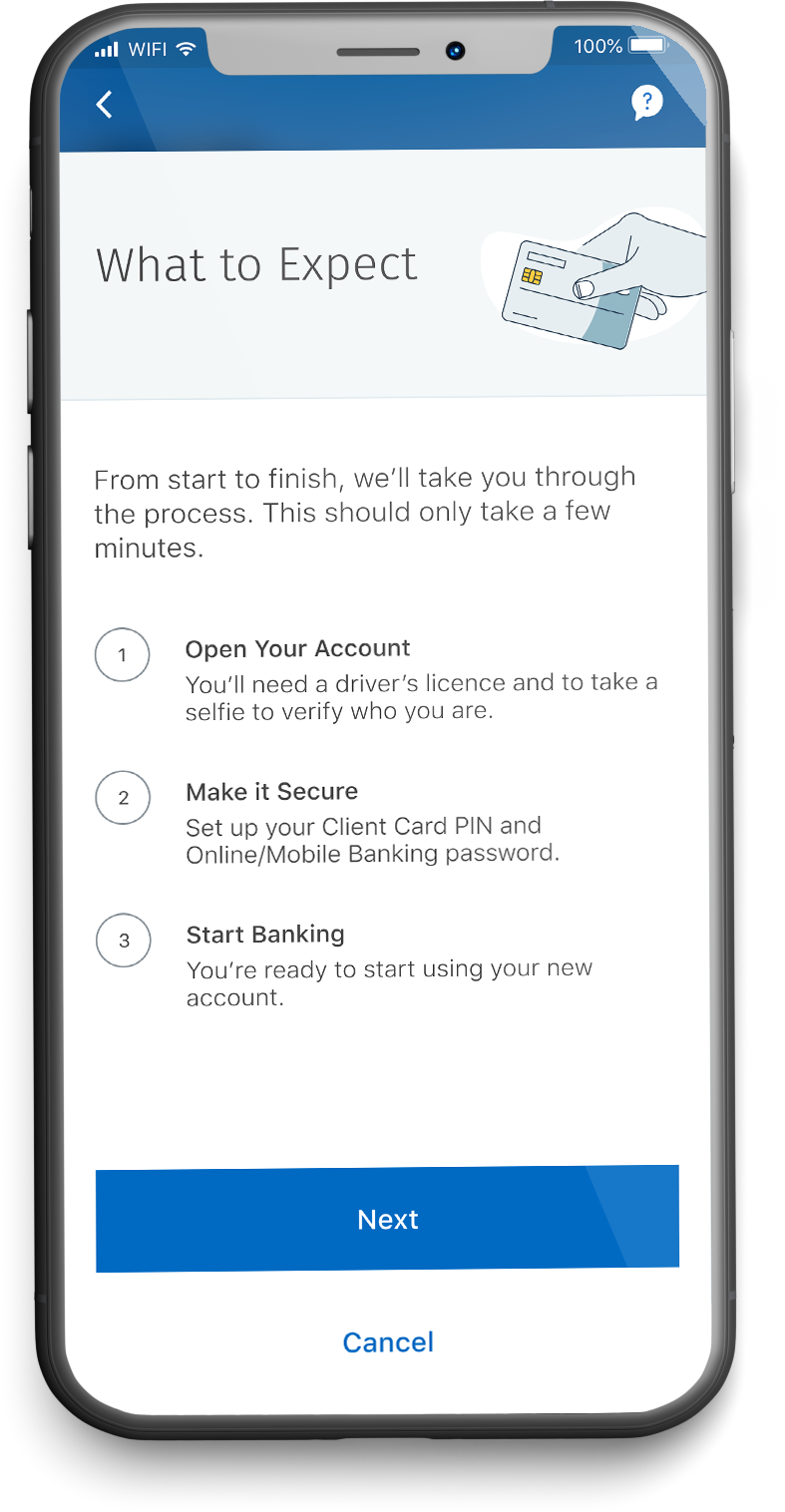

For many reasons, the new Remote Account Open experience is a great new option (for both the client and the bank). It works like this:

1) Through the RBC Mobile App (if you haven’t already, download the app to start), you can select the option to set up an account.

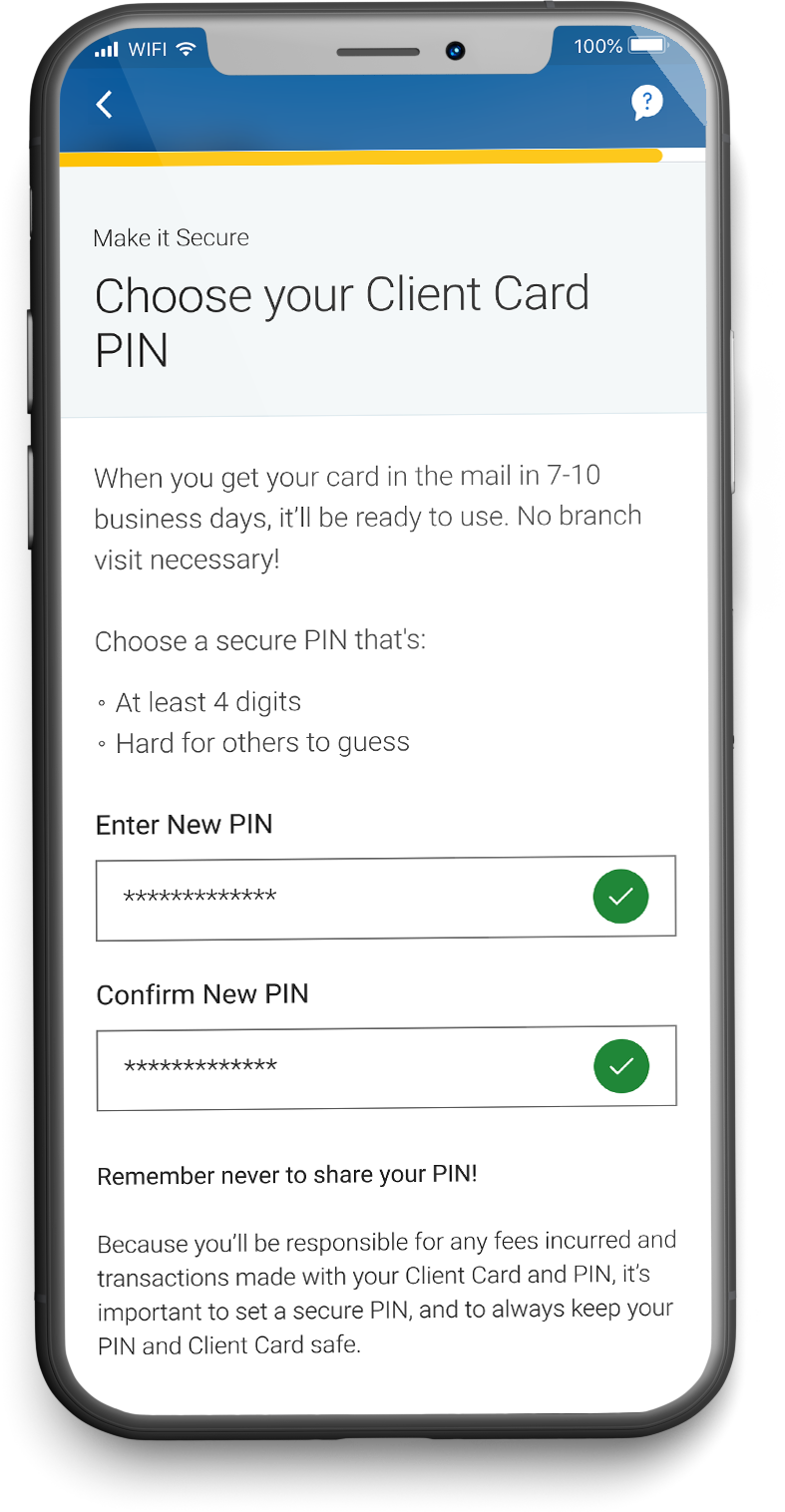

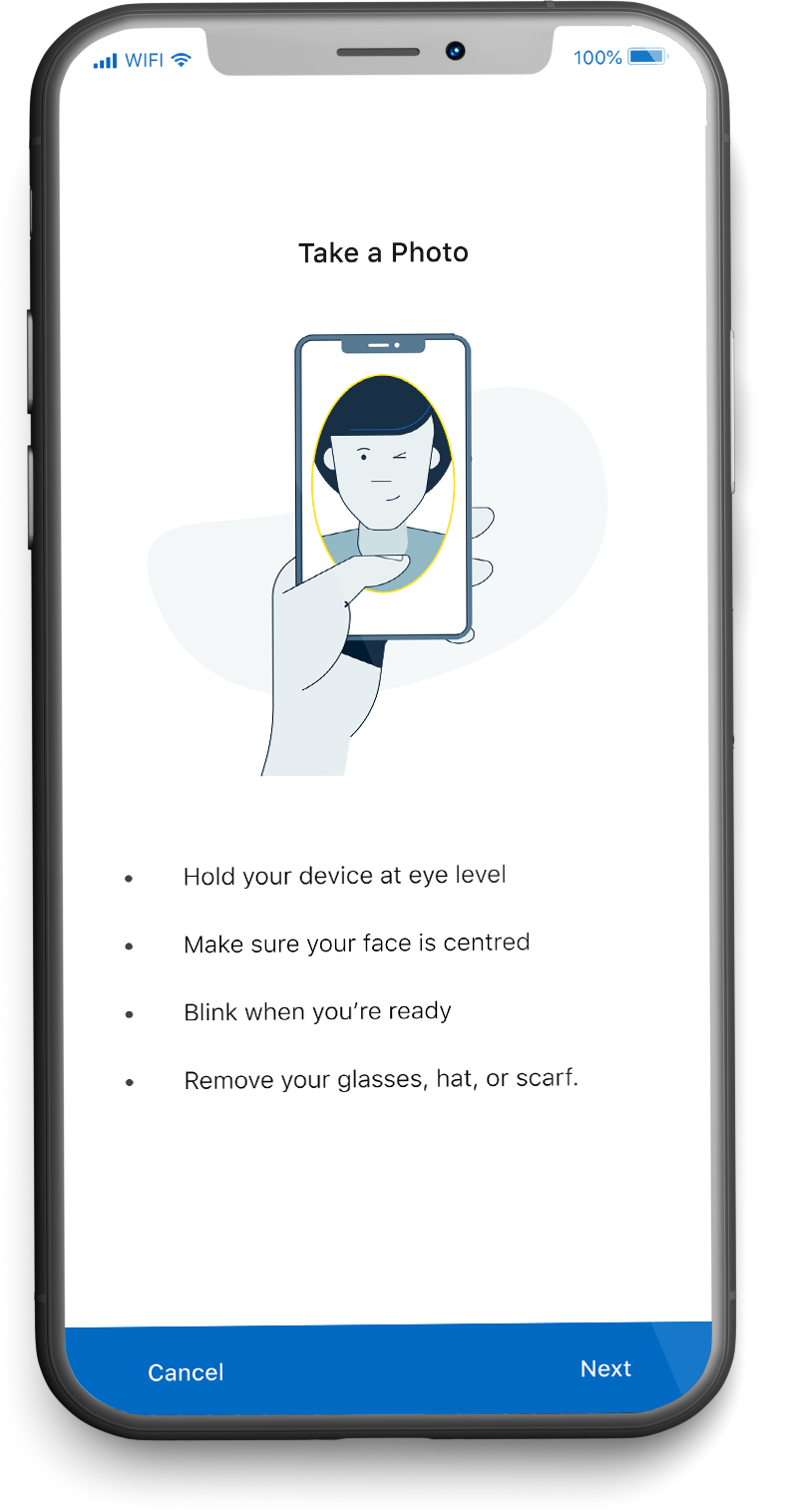

2) You snap a photo of your ID (eg. a valid driver’s license or permanent resident card) and your ID is verified. Your information will then be automatically populated into your account profile. The process is safe from a privacy and fraud standpoint, too. The ID verification technology checks your ID against government features to ensure it's valid, and you also upload a selfie in real time, which ensures that no one but you can open a bank account.

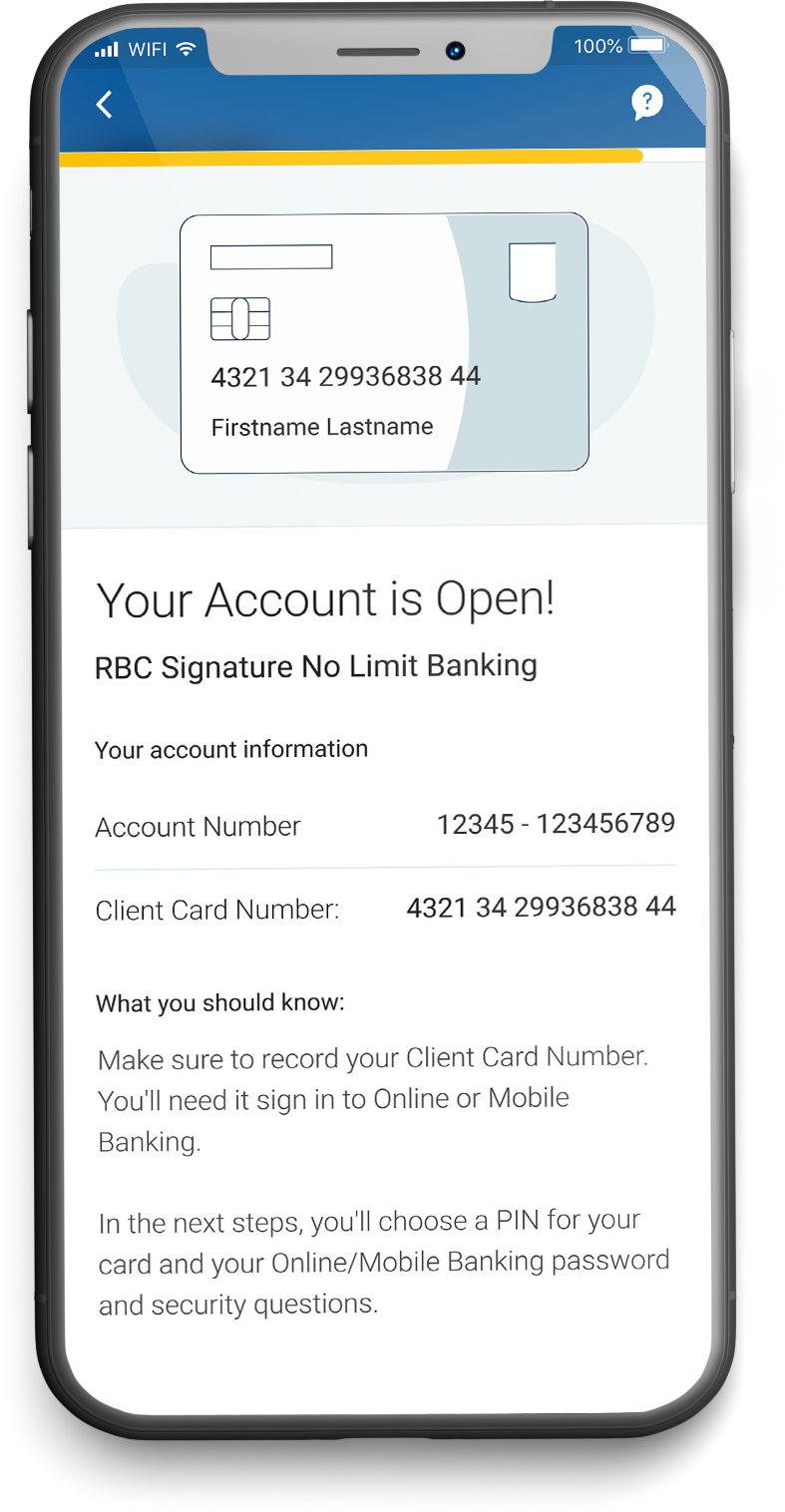

3) From there, you choose the type of account you would like to open, like a chequing account that doesn’t have transaction limits.

4) You’ll then be sent the necessary client agreements through secure email. You have to agree to these, btw. Personally, I keep these in my digital files just in case I want or need to reference them in the future.

5) Once finished, the account open process is completed, and you can set your PIN to begin transacting immediately. You may also find their NOMI Insights tracker helpful (included with your new account). NOMI analyzes your monthly cash flow, categorizes your spending, and more, to show you exactly what your money is up to.

If you need more custom support from an advisor, you can get it on the spot by way of notifying RBC that you need an immediate phone call, ensuring that you receive the same support and advice as you would in a branch.

With so many personal financial matters changing at the moment, keeping on top of your finances is key. This is where financial innovations like RBCs Remote Account Open experience can help. Open an RBC account remotely by downloading the RBC Mobile App from the iOS and Android App Stores.

**This post is brought to you in partnership with RBC