Money Basics for

your LIFE…and heart

The passionate person’s guide to getting good with money.

Make a money plan that you can stick to, create your money dream, fix your annoying debt and find new exciting ways to make money.

Take your entire life to the next level!

Our programs have been featured on:

Does this feel familiar?

You want to feel confident in your financial decisions, so that you can grow your savings with intention.

You’re motivated and ambitious, but feeling a little stuck when it comes to the numbers.

You’re frustrated and overwhelmed with all of the work you do, and yet feel like the financial progress you make doesn’t quite add up to the time and energy you put in.

You’re in need of guidance on how to reach your debt reduction goals, but are unsure of the questions to ask when it comes to money.

You’re ready to reach a new level of success with more ease and flow, and are sick of running on a treadmill.

You’ve been feeling shame about your debt and know it’s time for transformation.

You know you can save because you’ve done it before.

Does this sound like you?

It's time to get good with money.

(Even if you have no idea where to start)

What does being “GOOD” with money even mean?

Crush your debt … good.

Make a bigger impact … good.

Pay yourself first … good.

Build wealth … good.

Create more freedom … good.

If you’re ready to spend less time stressing about money, keep reading

You're not alone.

Let’s face it, talking about money kinda sucks.

We’re here to change that.

It's time to make friends with your finances

Re-Introducing Debt Crusher

Everything you need to own your financial success in a 6-module, stress-free training program for passionate people like you.

25+ Training Videos

2 Powerful Mindset Preparation Exercises

6 Swipe-Worthy Financial Workbooks

Money Mindset Training

Money Meditation

Expense Cutting Tips

The budget template all of our students are obsessed with

A monthly perk emailed to your inbox with a helpful tool to keep you on track

We're Here to Help.

Created by a heart-driven entrepreneur with over 20+ years of business and financial experience creating wealth completely independently, the Debt Crusher course was designed to help you cut through the confusion, and build financial confidence while creating more financial success for your life.

At a time when so much is changing, and the financial landscape is extremely challenging, having a roadmap to follow, and a support team to cheer you on, has never been more important.

If you're ready to take ownership of your success and create more abundance in your life, you're in the right place.

Want to know why money seems like a mystery?

It doesn’t have a mission.

You need a mission for your money.

You need money for your mission.

Create more money, make a bigger impact, help yourself, help others.

It’s that simple.

Your life needs money to operate, and to actualize those big dreams and goals you have personally and professionally - the more confident you get with your money, the more impact you can create, and the more freedom you can experience. Eliminate the blocks holding you back, like debt and bad habits, and you’ll create more meaningful success in your life.

What you'll learn

You’ll get access to proven systems, tools, and templates to increase financial confidence, crush your debt and boost your income while trimming the financial fat in your budget.

PLUS, you'll level up your money mindset, and let go of blocks holding you back from having a positive relationship with money.

Join Debt Crusher today and start learning how to:

Identify opportunities to make more money with your budget

Save money in your daily spending and become more profitable

Create systems and organization to increase personal productivity

Effectively balance your personal finances

Assess your relationship with money and understand the impact it has on your your life

Understand your limits and beliefs around money

Let go of money anxiety based on unconscious patterns

Change the way you think, feel, and talk about money, so that you can unblock the flow of money into your life

Build more confidence in your numbers and create an actionable and achievable money plan

Develop a plan for a financially successful future

One more thing!

You'll learn powerful strategies and money rituals to help you stay committed and accountable to your financial goals.

Invest in Your Future

Over $1,497 in value offered at the exclusive low price of only $8.99/month

BASIC MEMBERSHIP

$8.99/mth CAD

Cancel anytime

25+ Training Videos

2 Powerful Mindset Preparation Exercises

6 Swipe-Worthy Financial Workbooks

Money Mindset Training

Money Meditation

Expense Cutting Tips

Our super famous budget template

A monthly perk emailed to your inbox with a helpful tool to keep you on track

ACCOUNTABILITY MEMBERSHIP

$39.97/mth CAD

Cancel anytime

Everything in our BASIC MEMBERSHIP, plus

Monthly Email Accountability

Feedback on Your Net Worth Tracker

Custom Tips for Your Progress

If you’re a procrastinator or just know you need an extra nudge sometimes, this is your best option.

Course Content

In this step-by-step training program, you’ll gain financial confidence and learn actionable strategies to create more profitability and greater financial success.

MODULE 1

Financial Foundation Setting

Money mindset preparation for passionate people

Foundation setting on good vs. bad debt

Learn the framework for categorizing debt

Develop a financial plan for the future that includes a healthy relationship with debt

MODULE 2

The Numbers

Understand the numbers and what the heck they all mean

Create a habit of net worth tracking

Learn how to create forecasts and projections with your net worth

Discover how wealthy people improve their net worth

MODULE 3

Debt Crusher Method

Learn our secret sauce that has our students achieving major financial results

Get our system implemented within days

Immediately shift more money towards the most annoying debts

See your credit score start to rise within 90 days

MODULE 4

Money Mindset

Understand and change your relationship with money

Money rituals and routines

Money meditation

Level up your money goals

MODULE 5

Budgeting like a total boss

Trim the fat and staying lean in your spending

Make budgeting a regular routine that you actually like

Get our 30 powerful ways to save more

Prioritize saving for your future self

MODULE 6

Passionate people and their financial success

Uncover the secret ingredients our most successful students ALL have, and that you can have too

FAQs about consolidations, HELOCs and more

Commit to a new and beautiful money story

UNLOCK your BONUS worth $2,000 upon completion and implementation of all modules

Our 30-Day 100% Money Back Guarantee

Your success is our mission.

If you aren't absolutely satisfied after doing the work, and actively participating in the program, we'll refund your investment after 30 days. It's that simple.

That’s right! You have 30 days to give it all you’ve got, and if you’re still not happy with our program, we’ll give you your money back. No refunds after 30 days.

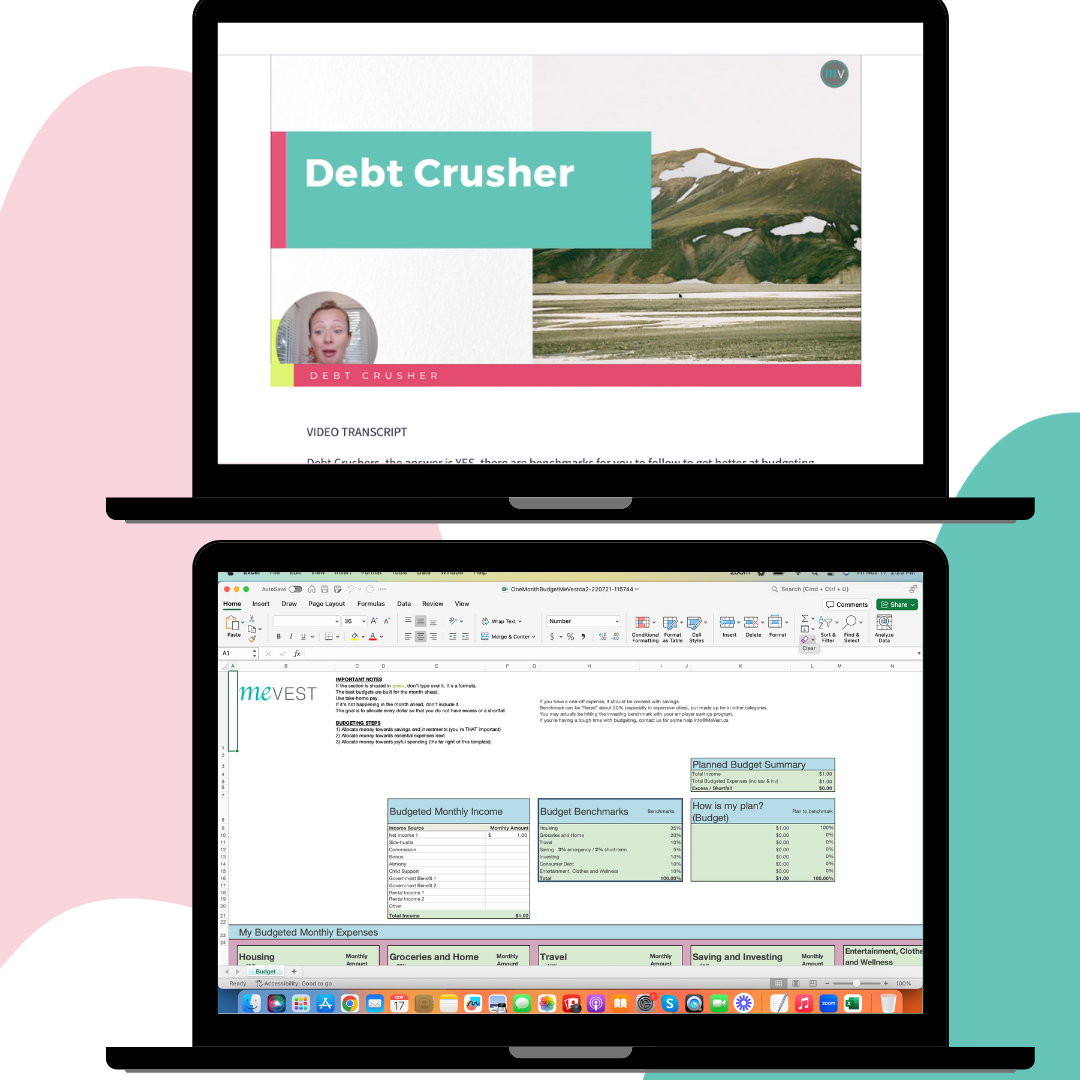

Done for you, essential financial templates included

Detailed walk-through on how to navigate the essential Debt Crusher templates

You’ll get all the nitty-gritty instructions on how to use the documents, dashboards, and automation that can be a little intimidating and confusing at first glance.

We’ll walk through everything and guide you through implementing it step by step so that you can confidently make this work for your finances.

Get right to work with our pre-made editable templates. With a click of a few buttons, you’ll have access to exactly what you need to own your numbers (and your financial success! ).

Each template and exercise comes with an instructional video on how to make it your own.

Net Worth Tracker

Financial Budget

The Debt Acceleration Method

The Mindset Shift

Lesley-Anne Scorgie

Money Coach, Financial Strategist, Author & Founder of MeVest

Lesley-Anne is a 3x best-selling author, Founder, and Money Coach on a mission to make money feel simple while making it work for you.

Working with Lesley-Anne will help you to reach your financial potential, and become more confident in your money choices while creating a positive relationship with your cash.

She’s the brains and passion behind the Debt Crusher program. She understands your passions, and wants to see you rise up!

What People are Saying

“Since starting to work with Lesley-Anne 4 months ago, I have paid off my credit card ($7200) and have increased my net worth by $15,000... And I am not even done yet."

- Alison

"Financially I feel in control and less stressed. There's nothing like improving your life and having control over your finances - I am excited to grow my money and my future!"

- Kristina

"My credit score went up after 90 days of implementing Lesley-Anne’s system. I’ve also increased my net worth by $12,000 in that same period of time. This WORKS! I’ve recommended her program to all of my friends and family.”

- Sandra

"I’ve crushed $59,000 of debt in a year! This has been one of the most important investments in my life and I’m thrilled with the results."

- April

Frequently Asked Questions

-

This program was created for people who are ready to own their financial potential and success.

-

Yes. You can join from anywhere in the world, as long as you have an internet connection.

-

Each video is between 7-20 minutes long.

-

Yes, all training will be recorded and available for you to watch at any time within Thinkific.

-

Our Basic Membership (without email accountability) is $8.99/month. You can cancel anytime.

Our Accountability Membership (email support and accountability monthly) is $39.97/month. You can cancel anytime.

Your first payment is due upon enrolment, and you will be charged each month after that. If you require a payment alternative, contact info@mevest.ca

All prices are in Canadian Dollars.

-

We have a do-the-work policy. If you actively participate in program for 30 days and do not experience more confidence in the financial shifts in your life, we’ll refund you. After 30 days, there are no refunds.

-

No. The core financial principles apply on both sides of the border. Lesley-Anne and her team are Canadian.